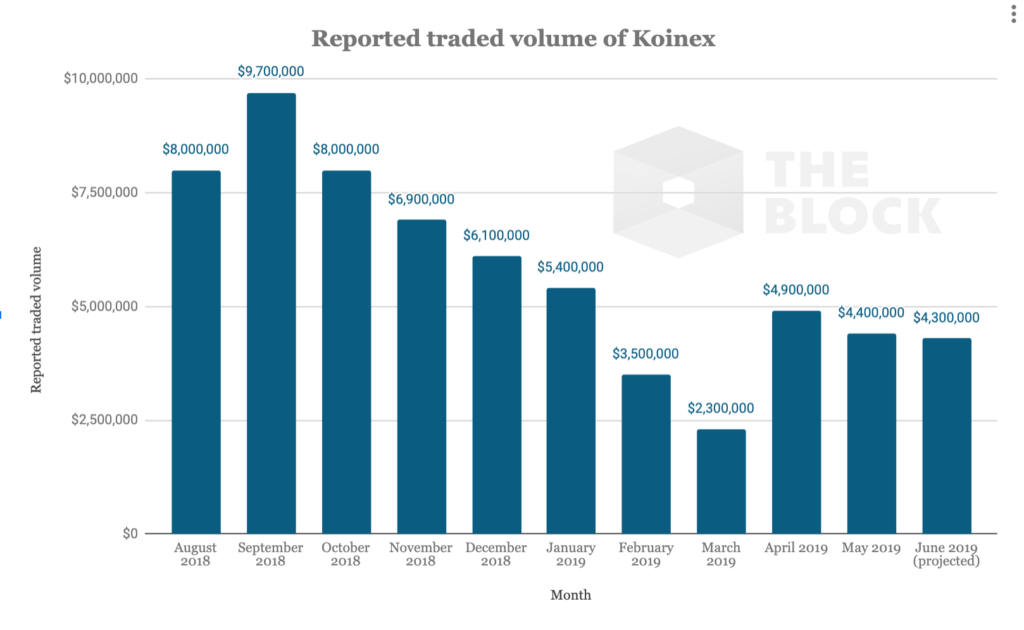

.Indian cryptocurrency exchange Koinex is shutting down today. The company has decided to close its operations due to facing continuous loss from last 14 months.

Cofounder Rahul Raj made this official announcement today on his Medium blog post.

Since we began operations in August 2017, we at Koinex have always aimed to do our best to provide blockchain enthusiasts in India with the highest standard of service in the trading of digital assets. However, over the past 14 months, it has become extremely difficult to operate a digital assets exchange business in India. After months of uncertainty and disruption, we have regretfully decided to shut down all exchange services and operations from 27th June 2019.

We set up Koinex in the summer of 2017 and began digital assets exchange services on August 25, 2017. As the first open order-book, fully KYC compliant, multi-asset exchange, we opened the world of blockchains to India, bridging all gaps in trading compared to international counterparts. Within 4 months of operations, Koinex became India’s largest and favourite digital assets exchange — recording $265M in trading volume and on boarding 40K+ new users in 24 hours at peak in the month of December. Koinex also became India’s fastest growing startup to see such metrics and an ultra-quick profitability.

However, this short-lived astronomical growth curve was stalled with the emergence of issues with formal banking channels on which exchange services were deeply dependent on. On April 6, 2018, the Reserve Bank of India issued a circular instructing all regulated financial services entities to exit relationships with companies and individuals dealing in virtual currencies and block all such crypto-related transactions. While the RBI circular, resulting into a complete banking ban, has been challenged in the Supreme Court of India, the status quo since April 2018 continues till today.

The last 14 months have been tough to operate a digital assets trading business in India, on account of the closure of bank accounts holding user deposits. We took on immense financial burden to continue trading of digital assets and allow law-abiding Indians to participate in the decentralized revolution that has swept across the globe. Multiple delays by the government agencies in clarifying the regulatory framework for cryptocurrencies despite our pending writ petition in the Supreme Court of India, coupled with regular disruption in our operations, the final decision has been taken after duly considering all the latest developments in the crypto and blockchain industry in India. We have stayed away from disclosing details to the public in the larger interest of mindfully steering the industry towards positive regulations, but unfortunately we’re not too hopeful that things will change for the better in the near future.

The last 14 months have been tough to operate a digital assets trading business in India, on account of the closure of bank accounts holding user deposits. We took on immense financial burden to continue trading of digital assets and allow law-abiding Indians to participate in the decentralized revolution that has swept across the globe. Multiple delays by the government agencies in clarifying the regulatory framework for cryptocurrencies despite our pending writ petition in the Supreme Court of India, coupled with regular disruption in our operations, the final decision has been taken after duly considering all the latest developments in the crypto and blockchain industry in India. We have stayed away from disclosing details to the public in the larger interest of mindfully steering the industry towards positive regulations, but unfortunately we’re not too hopeful that things will change for the better in the near future.

We have consistently been facing denials in payment services from payment gateways, bank account closures and blocking of transactions for trading of digital assets. Even for non-crypto transactions like payment of salary, rent and purchase of equipment, our team members, service providers and vendors have had to answer questions from their respective banks — just because of an association with a digital

assets exchange operator. One of the toughest things to handle is explaining to our team members why they get a call from their bank every month at the time of salary credit. The recent news broken by BloombergQuint and later reported by MoneyControl about a proposed piece of legislation called the ‘Banning of Cryptocurrencies and Regulation of Official Digital Currencies Bill 2019’ has created enough FUD in the Indian crypto trading community to result into a sharp decline in trading volumes and instil a clear discomfort for all the law-abiding citizens of this great nation.

Amidst all of this, from a basic economic feasibility point of view, it is just not prudent to continue doing this business. The amount of capital, effort and grit that’s required to conduct a complicated business like this is just increasing with no relief in sight — the infrastructure cost alone for operating the exchange platform and ensuring the safety and security of users’ funds is unbelievably high. Adding to that the costs for legal, customer support and a cluster of other functions, continuing to conduct the business is proving to be an unwise idea with no scope to make revenues to cover for them.

Some Important Dates and Details

The digital assets trading services will be permanently disabled on all our platforms at 2.00 PM IST on Thursday, June 27, 2019. All open orders after this deadline will be automatically cancelled and the funds will be returned to corresponding wallets. Users are requested to plan their trading activity carefully and close their trade positions.

A snapshot of the wallet balances at this time will be taken for record, and the effort to disburse INR balances will begin immediately. Since the bank accounts with user funds are still frozen and the capital is held up, we have made arrangements for funds from our own resources, so that we return as much as we possibly can, back to our users and alleviate their position in reference to the funds held up in these frozen accounts. This is a voluntary move and is being undertaken even though it is not our legal obligation, only with a view to reduce the hardship that it is causing to so many of the users who reposed faith and supported our business effort while things were not constrained. This is our way of saying ‘thank you’ and bidding adieu.

That said, we want to underscore that this is being done merely as a voluntary effort, out of good faith and in order to end things in as elegant manner as we can afford. We are not out of place in repeating that the funds to repay our users for the balances that are locked up in the frozen accounts are being paid from our own resources and comes at a cost to arrange such funds. In the course of the next 5 weeks, we will attempt to release all user deposits to their registered bank accounts after levying a convenience fee (between INR 10 and INR 2000, depending on the INR wallet balance).

The digital assets wallets will continue to be functional, and users will be required to withdraw all funds from the platform before 9.00 PM IST on July 15, 2019. Failing to do so may result in forfeiture of their funds, in case we are unable to keep the wallet function alive post the aforementioned timeline.

Our customer support team will be available throughout this transition period, resolving all pending queries and issues for all our users to the utmost satisfaction. We will also continue to be responsive on all our social media channels and we urge the users to only communicate with the official modes communication to avoid any kind of mishappenings.

A note of thanks to our users and the community

From the bottom of our hearts, we would like to thank every single user of Koinex. It has always been the driving force for the entire team to continue to struggle through all the problems we have faced in the past one year. Innovations in our product offerings, the wit to file a representation with the RBI providing a working blueprint for regulations and effective reporting, and the courage to file a writ petition against the RBI circular in the apex court in India, all our efforts have gone into making it possible for our users to have access to the opportunity of interacting with the technology of the future. We did everything we could, in return for all the love, support and encouragement we have received from our users throughout this wonderful journey. We are thankful and proud.

We would also like to take a moment to thank the founders of all other exchanges, the journalists sharing the right information and highlighting the right set of issues to discuss, the founders of other blockchain projects, and everyone else who had an intent and a role to play in the right direction.

As a bunch of energetic product-oriented professionals, we will continue to focus towards serving the Indian populace. We remain committed to our goals of enabling financial sovereignty and deepen financial inclusion, even if digital assets are no longer the vehicle we use to accomplish these goals. India is a dynamic economic powerhouse and we are on our way to find the next big challenge that propels growth and changes the lives of over a billion people.

Jai Hind.

Trading services and operations on all Koinex platforms will be permanently disabled at 2.00 PM IST on Thursday, June 27, 2019. In case of any queries, users are requested to visit the FAQ page on our website — which contains all frequently asked questions and will answer most of the queries. Users can also raise a support ticket directly from the FAQ page.

Note: This News is originally published on Medium.com